My Biased Opinion on EURxb and XBE

April 12, 2021

What would the proposed vault deposits and token mechanisms mean for holders of EURxb stablecoin, or XBE governance tokens in the protocol?

Disclaimer

The below is my personal opinion, and though I am an advisor to EURxb, this does not necessarily represent the views of EURxb.finance, or their launch partner Miris with whom I work. Furthermore, this is certainly not financial or investment advice – and if anybody wants to participate in the project I highly recommend they research the facts independently, to be weighed for themselves.

For full disclosure, I am biased in my views as I personally hold both EURxb stablecoins and XBE governance tokens in my portfolio over and above advising the team from time to time. This article is intended to capture my thoughts and share how I understand the project, what they are trying to do, what they have accomplished so far, and what I think they are likely to achieve in future.

A Singular Vision

The EURxb has set out to take on quite a daunting challenge in bridging the Traditional Finance and DeFi markets with their vision:

Creating a protocol that will allow users from the regulated securities market to cross over and enter into Decentralised Finance and participate in, amongst other things, yield enhancement programs to amplify the returns of their existing traditional investments.

This vision was very recently unpacked here. But in order to deliver on this, they need to overcome the substantial gap between the bean-counters from the off-chain world and the trustless, already-audited ledger of the public blockchain. Tobie also published a deep-dive on that topic that’s worth reading.

Over and above the traditional finance concerns, the obstacle of ensuring tokenholders rights through a chain-of-custody within the regulatory regime that the real-world senior secured green bonds (protocol reserves) reside in loomed large. Paul deftly unpacked how they address that as well.

In simple terms, this team is not ignorant of the realities, nor shying away from difficulties.

There has clearly been a tremendous amount of experienced, high calibre thinking invested in openly publishing how the team are addressing the material challenges that stand between them and realising their vision.

Sufficiently Decentralised

Many stablecoin projects that provide off-chain reserves depend on a single custodian to manage those assets, and with the EURxb stablecoin the team has gone to great lengths to shift that burden onto a regulated market instead of a single entity. In the same way, the decentralisation of ownership of the protocol in the tokenised space is critically important.

This requires the EURxb protocol to effectively distribute control and governance rights as far and wide as it possibly can, to ensure that it achieves the “sufficient decentralisation” that it needs to be able to give users in the decentralised world as well as those in the traditional world confidence that it is not at the mercy of a few individuals who could make a mistake, fail to act as expected, or otherwise cause a central failure point.

XBE provides this decentralised control mechanism to the protocol, and grants holders authority over all aspects of the protocol. Of the maximum supply of 15,000 tokens 12,000 XBEs was distributed freely and fairly and is currently in circulation.

The remaining 3,000 is held to be allocated according to governance proposals by the XBE community – intended by the founding team to ensure sufficient capital is available to cover protocol maintenance, upgrades, expansions and whatever may be required to autonomously operate and govern the EURxb protocol after they have deployed the core protocol modules.

I think that governance will play a far more important role in the EURxb protocol than is obvious right now, but it is still very early days for XBE. The critical feature of the XBE token – it’s ability to vote on proposals – empowers it to also determine how the protocol’s surplus revenues from the Institutional Vault product is distributed, and what earning strategies are to be accepted into the XBE Institutional Vault that deploy the current 53m EURO of mandated institutional EURxb tokens in DeFi.

The purpose of the EURxb

As a stablecoin the EURxb offers another EURO currency option for users, but it sets itself apart in two substantial ways. Firstly, no other stablecoin that holds real-world reserves is offering interest, so this is a clear first in the market. Secondly, the 7% yearly return on tokens held in your wallet (not deposited in a smart contract) is lucrative for owners that want to own their own keys - allowing earning even in cold storage. These however are just the beginning of what will make the EURxb so attractive to users.

The EURxb provides an instrument that allows the holder to deploy it for additional earnings in DeFi yield strategies - but these yields are known to be highly volatile. Returns of 1,000% APY are often advertised - which is just the rate of return on capital at that moment extrapolated on the basis that the same rate will be sustained for a full year forward. In reality this is never the case, as these opportunities are designed to attract liquidity which (as it enters) dilutes the other investors rate of return dramatically, and furthermore the reward programs are for limited time periods (measured in days and weeks), so the reward does not persist for a full year term.

This leads to the idea of taking your capital and deploying it in a new opportunity as soon as the current one is diluted, or the reward period terminates, pursuing the highest rate of daily profit possible - with many days of substantially sub standard returns. The EURxb’s native 7% return has a major impact on the overall annualised rate of return for these type of investors, as they can reliably count on a further realised 7% risk free for each year over and above the erratic and often highly risky and speculative earnings they pursue.

Furthermore, what makes the EURxb exceptionally attractive is that it provides a mechanism for individuals and entities that seek to prove their legal rights to the instrument in an enforceable manner an opportunity to either just benefit from the 7% return, or deploy their capital in a managed DeFi Vault (the XBE Institutional Vault) for an additional return of up to 5% (bringing the total annual yield up to 12% per annum for a “fire and forget” investment), or take up some of the EURxb liquidity themselves and try their own hand at the wilder west of Decentralised Finance.

The same “fire and forget” approach also allows less literate investors a simple and reliable entry into this exciting space - an audience who only grows in number by the day.

The XBE Institutional Vault

I just mentioned the XBE Institutional Vault and users who need to prove their rights to their tokens, and those actually tend to be the bigger fish in the traditional finance space who have extremely strict guidelines about what they are able to do with their investors’ funds and while cryptocurrencies and even stablecoins – due to all the reasons Tobie elaborates on – leaves their managers with a headache, investment grade senior secured green bonds are perfectly acceptable.

This opens the door for new institutional clients to partner with EURxb – over and above the commitment of a further 4 bond issue tranches of 100m EURO each that Miris has already indicated they intend to launch before end of 2021. This fact excites me – because it points to the EURxb protocol’s capacity to scale to multiple times the 53m EURO investment in the XBE Institutional Vault over the course of this year, and even more in future.

Traditional investors are under pressure to increase their profits without risking increasing the risk to their customer’s capital, and simultaneously having to deliver on “impact investing” targets that include prescriptions to deploy more funds into green and sustainable programs. Thanks to the EURxb protocol, they can now achieve all of that by simply holding subscriptions to MIRIS’s Senior Secured Green Bond on their books and electing to have their position managed in a tokenised secondary market that provide a yield enhancement on the standard 7% bond rate up to a further 5% per year.

Understanding Protocol Revenues

As with all new ventures, new revenue models will likely be added over time, however the main earning mechanism for the protocol is the surplus rewards generated on the XBE Institutional Vault, after paying traditional finance depositors the capped 5% APY.

Naturally there are strict guidelines about what kind of risk levels the investment strategies are able to use when deploying the XBE Institutional Vault funds.

These yield strategies don’t necessarily provide for the same eye-popping 1000%+ APY rates that draw massive investment in the DeFi markets today, but it would not be a reach to expect them to deliver conservatively around an average of 15% APY – and even substantially more with some clever structuring and design.

A quick estimate then places protocol earnings around 10% per year on the ±$ 62m USD (53m EURO) per day in the Vault, which we can round down to $ 16,950 per day as a baseline. This would be only on the initial commitment of 53m EURO in traditional investors in the XBE Institutional Vault - and excludes scenarios catering for greater results than the assumed 15% APY.

XBE Holders and Reward Distribution

The generally accepted model in discussion with the XBE community at the moment is that the community will vote to have 100% of the protocol revenues distributed to XBE holders, proportional to their staked holdings of XBE. Platform upgrades and maintenance costs are otherwise provided for already through the community treasury fund you can check here.

A simple calculation says that once such a proposal is accepted and incorporated into the protocol, you would divide the conservative estimate of $ 16,950 daily protocol revenues by the 12,000 circulating supply of XBE. However, that is optimistic because generally only 40-70% of tokenholders in projects stake their governance tokens, as staking takes tokens off the market. That reduces the number of tokens amongst which the protocol revenues would potentially be divided by to only 8,400 instead of 12,000.

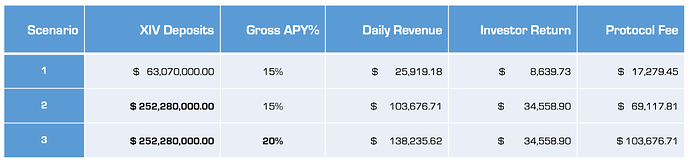

The below table presents 3 scenarios.

Scenario 1 has the minimum mandated deposit in the XIV, with a gross APY of 15%. Scenario 2 increases the deposit figure on the assumption that the next 4 issuances also proportionally allocated funds for similar investment. And Scenario 3 takes this increased deposit at a gross APY of 20%.

Experimenting with some Deposit Value and Gross APY % Scenarios

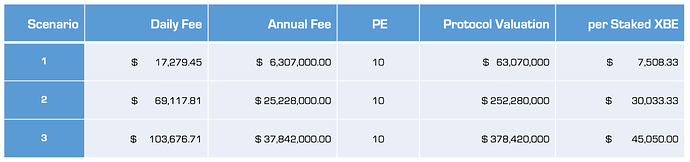

Thoughts on an XBE Market Cap

DeFi projects see PE valuations that would leave the most aggressive dot-com boom VCs breathless, but they are indicative of the significant scale, growth and commercialisation that investors believe serious projects in DeFi are expected to undergo in the near future.

I will let you depend on the many great writers on this subject before me to better explain and provide the evidence to why and how the PE range of 15 to 100 is commonplace. It is serendipitous that one of the earlier articles (Are DeFi Tokens Worth Buying? - Bankless) was penned by a Lucas Campbell (whom I have no relation to), and while there are many newer and even more relevant articles today, we should not give up a chance to enjoy a happy coincidence.

For the sake of this opinion piece I will just happily assume the very low end of the seemingly accepted PE range at a PE of only 10. If all these assumptions bear out, then it could drive XBE tokens to trade at the below numbers using the estimated annualised rewards from earlier. Again, for the record - this is my biased opinion.

A Biased Opinion - Not Financial Advise!

Returning to Terra Firma

The EURxb protocol is currently proving product market fit with its launch partnership, and as it matures and deploys the rest of the protocol both the traditional and decentralised finance communities should find it easier to see the same vision as the founding team.

This however will translate to the protocol’s governance token trading far below the figures I alluded to, leaving the serious believers ample time to accumulate sizable positions of this quite limited commodity.

I’ve been privileged to see first-hand the level of investment from the founding team in bringing the EURxb protocol and the XBE token to life, and there is an unwavering commitment to see this through as evidenced by their public disclosures, as well as the personal time taken to engage community members across multiple project channels.

Together with the exceptional strategic significance of a solution that can effectively bridge the traditional securities market with the innovation of decentralised finance, and the critical breakthrough for a project of this nature in concluding a launch partnership with the volume and backing that they’ve already delivered, it is hard not to get ahead of oneself with excitement.

Last Words

After allowing my thoughts to wander to “what-if” land, I am drawn back to the key driver behind the exceptional investor confidence in serious DeFi projects. An almost incomprehensible potential to scale. This strikes me as the most important aspect to consider when weighing the potential future value of a project in this exciting space.

As they succeed with first one partner, and then more, applying scale to the EURxb protocol means increasing investor funds in the XBE Institutional Vault 1,000 fold – not 5 fold. It also means expanding the EURxb protocol beyond just the $40tn corporate bond segment of the global regulated securities markets – reaching into the $70tn equities, and even the $90tn government/state bond sectors… a market that the founding team has undeniable ties with when it comes to tokenising securities.

That leads me to the other aspect that drives investor confidence - time. Projects with staying power inevitably get the greatest support. What I most appreciate about this team is that they seem to understand this. They’ve taken a no-nonsense approach, taking small steady steps to ensure they have a solid foundation before they break into a run. In a world where announcements of announcements and big promises rule the day, their style will probably see the XBE token trade for a fraction of its true value, while they just keep growing and expanding.

That is likely to hold until the first rewards are paid out from the XBE Institutional Vault to staking XBE holders. When the market finally realises what is happening right in front of their own eyes – DeFi users profiting directly from traditional investor funds in regulated investment instruments – the XBE could suddenly experience tremendous demand, and with such limited supply of tokens in circulation, it could leap several multiples in value overnight.